Mon 15 Jul, 2024 – 9:48 AM ET

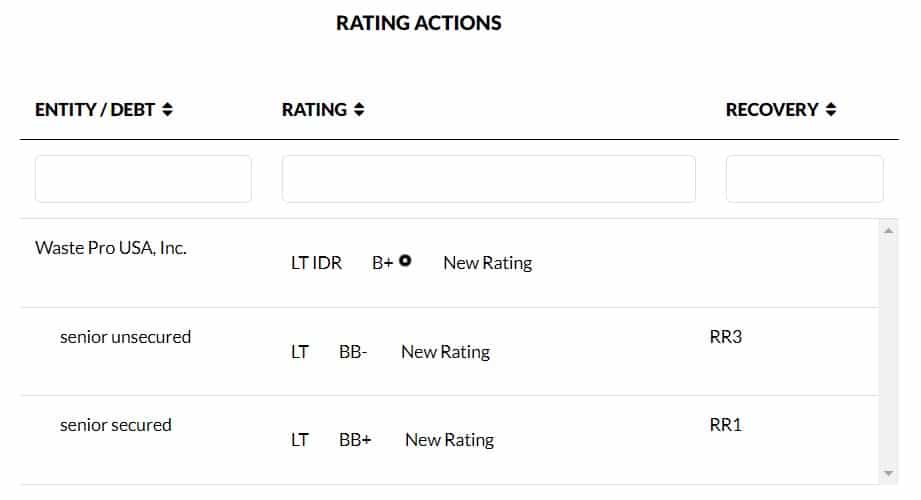

Fitch Ratings – Toronto – 15 Jul 2024: Fitch Ratings has assigned a ‘B+’ first-time Long-Term Issuer Default Rating (IDR) to Waste Pro USA Inc. Fitch has also assigned a ‘BB+’/’RR1’ rating to the company’s ABL and a ‘BB-‘/’RR3’ rating to its senior unsecured bonds. The Rating Outlook is Stable.

Waste Pro’s ‘B+’ IDR reflects the inherent stability of municipal solid waste (MSW) collection across economic cycles, its multi-year service contracts with a long-term, diversified customer base and established position in the growing U.S. Southeast. The rating is also supported by Waste Pro’s selective contract bidding and renewals that enhance route density and cost recovery.

Fitch’s rating case forecasts neutral-to-positive annual FCF generation, which the company could enhance, if needed, by paring back growth spending. Fitch also projects, excluding potential large acquisitions, EBITDA leverage and interest coverage around the low to mid-4.0x range in 2024. M&A activity could lead to variability and deterioration in credit metrics to levels that are generally consistent with ‘B+’ rating tolerances. Waste Pro’s concentrated ownership profile introduces governance risks, such as potential large distributions, but this is mitigated by management’s track record of prioritizing business investment.

KEY RATING DRIVERS

MSW and Contracts Create Stability: Approximately 73% of revenue is tied to residential and commercial waste collection services, which are fairly stable through economic cycles, due to consistent waste generation from households and businesses. Waste Pro’s contracts with municipalities can stretch 5-10 years and, together with and its ability to retain customers, this provides added earnings visibility. A portion of its revenue is from construction and demolition activity which tends to be relatively more susceptible to business cycles.

Long-term growth fundamentals in Waste Pro’s core operating regions are supported by secular growth trends and population shifts that also support active construction-driven business.

Growth Investment-Linked Leverage Profile: Fitch forecasts EBITDA leverage of 4.2x in FY24, down from 4.8x in FY23, primarily driven by pricing increases, shedding less profitable contracts, and volume growth resulting in increased EBITDA and margin in the year. Fitch expects Waste Pro to continue to prioritize growth, which leads to our expectation of EBITDA leverage moving into the 4.5x-5.0x range during significant growth periods, a level that is consistent with ‘B’ category environmental services companies. Fitch recognizes the attractive return profiles of bolt-on M&A and growth capex, as well as the company’s meaningful growth-linked capital flexibility. Management has indicated that it would prioritize deleveraging toward 4x following any future leveraging event.

FCF, Financial Flexibility Improving: In the near term, Fitch expects FCF, after growth capex, to turn neutral-to-positive on stronger EBITDA margins and measured capital spending. Growth spend is typically comprised of truck and container purchases (roughly half of total capex). Fitch believes Waste Pro retains flexibility to manage FCF by paring back growth investment and repositioning trucks in a downturn or customer loss scenario.

Fitch expects the company to maintain EBITDA interest coverage around the low-to-mid 4.0x range over the medium term, excluding large acquisitions, a level that is relatively strong for the ‘B+’ rating. Even during heightened inflationary pressures in 2021 and 2022, EBITDA interest coverage remained above 3.0x due to a largely fixed-rate debt mix and access to advantaged tax-exempt bonds.

Operating, Pricing Improving Profitability: Fitch expects continued organic EBITDA margin improvement in 2024 to 20% from nearly 19% in 2023. Strategic initiatives to enhance profitability have led to shedding low-return contracts, and pricing implementations are catching up to the heightened inflationary environment. Waste Pro’s open market contracts (40% of 2023 revenue) provide an opportunity for more frequent and higher adjustments than restricted price contracts, which typically peg to broad inflationary measures. Fitch also believes Waste Pro benefits to some degree from its larger peers prioritizing pricing rationality over aggressive volume growth.

Business Profile Considerations: Waste Pro’s ratings are not currently constrained by its business profile, which exhibits ‘BB’ category characteristics, though its regional focus, smaller scale of cash flow relative to investment opportunities and collection-heavy operations are key credit considerations, relative to large publicly traded MSW firms. The focused geographic exposure introduces region specific competitive, regulatory, political or weather-related risks though these currently appear manageable.

Large MSW firms benefit from a higher degree of vertical integration with disposal into company-controlled landfills, supporting a stronger ability to manage respective cost structures. However, Waste Pro’s focus on disposal-neutral markets provides optionality in disposal and reduces longer-term liability exposure.

DERIVATION SUMMARY

Fitch compares Waste Pro to environmental service peers such as Reworld Holding Corporation (B+/Stable), Stericycle (BB/RWP) and the large municipal waste management companies. Reworld owns and operates a network of waste to energy facilities and sells electricity and recycled materials that are created or captured in the waste incineration process.

Reworld’s asset profile has less replacement risk than Waste Pro’s due to its geographically advantaged and regulatorily constrained incineration assets. This is partially offset by Covanta’s moderate exposure to energy and commodity prices that Fitch views as more volatile than Waste Pro’s focus on contracted waste collection service. Waste Pro’s expected EBITDA coverage ratio, excluding a material growth-linked leveraging event, of 3.5x-4x is stronger than Covanta’s anticipated EBITDA coverage ratio around 3x.

Stericycle is a public peer and a leading provider of medical waste and document shredding services. Relative to Waste Pro, Stericycle has maintained a track record of financial policy that manages a relatively stable leverage around 3x and a strong coverage above 6x.

KEY ASSUMPTIONS

– Organic revenues grow in the low teens in 2024 driven mainly from strong pricing improvement and volume growth.

– Revenue growth tempers to mid-single-digits towards 2026 on moderating pricing and volume growth.

– Organic EBITDA margin expands 125 bps in 2024, benefitting from the shedding of low-return contracts and strong pricing that outpaces cost inflation. Margin expansion moderates to 25 bps annually from 2025 to 2026.

– CAPEX around 12% revenue in 2024, equally split between maintenance and growth initiatives. Beyond 2024, the intensity of growth CAPEX slightly reduces, in line with tempered organic revenue growth.

– Debt-funded M&A, which could include bolt-on or large-scale transactions are pursued, sustaining leverage in the 4.5x-5.0x range.

– No material shareholder distributions.

RECOVERY ANALYSIS

The Recovery Rating assumes that Waste Pro would be reorganized as a going concern (GC) in a bankruptcy scenario rather than liquidated. A 10% administrative claim on the enterprise value is assumed.

Fitch estimates Waste Pro’s GC EBITDA at $150 million. The GC EBITDA estimate reflects Fitch’s view of a sustainable, post-reorganization EBITDA level upon which we base the enterprise valuation. Fitch assumes a hypothetical bankruptcy scenario could come from a combination of contract losses and weaker margins stemming from intense competition, structurally weaker pricing environment while the company contends with higher cost inflation.

Fitch assumes Waste Pro will receive a GC recovery multiple of 6x. This multiple is applied to the GC EBITDA to calculate a post-reorganization enterprise value (EV). The multiple assumption is primarily driven by the recurring demand inherent to the waste management industry and the longer-term and diversified nature of contracts. It also reflects the company’s vulnerability due to its regional focus. The multiple is lower than the 6.3x assigned to Covanta which benefits from its geographically advantaged and regulatorily constrained incinerator assets. The multiple also considers Waste Pro and the larger waste companies’ historical acquisition multiples.

Fitch’s recovery scenario assumes that the ABL is 80% drawn. The ABL receives priority above the unsecured debt in the distribution of value in the recovery waterfall. The Recovery Rating results in a ‘BB+’/’RR1’ rating for the ABL and ‘BB-‘/’RR3’ for the unsecured debt.

RATING SENSITIVITIES

Factors That Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

– Demonstrated commitment to credit conscious capital allocation strategy that maintains a through-the-cycle EBITDA leverage below 4.5x;

– Consistently positive FCF, after growth capex.

Factors That Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

– Deviation in capital allocation and financial policy leading to EBITDA leverage sustained above 5.0x;

– EBITDA interest coverage sustained below 2.5x;

– Reduced financial flexibility indicated by sustained negative FCF and ABL availability below 75%.

LIQUIDITY AND DEBT STRUCTURE

Adequate Liquidity: As of March 2024, Waste Pro had $188 million of liquidity, consisting of $164 million availability on the ABL and $24 million cash. Liquidity is also supported by Fitch’s expectation that FCF will turn neutral-to-positive in 2024 and that the company could scale back growth CAPEX to preserve and generate liquidity in a stress scenario.

Waste Pro has a largely fixed-rate debt mix and benefits from advantaged tax-exempt bonds. The company does not have a major maturity until June 2026 when $480 million of its unsecured bonds mature. The company also has $21 to $23 million of debt amortization in 2024 and 2025, respectively.

ISSUER PROFILE

Headquartered in Florida, Waste Pro provides non-hazardous solid waste management services, focusing on collection for residential, commercial, and industrial customers. The company operates across nine states in the southeastern U.S.

ESG CONSIDERATIONS

The highest level of ESG credit relevance is a score of ‘3’, unless otherwise disclosed in this section. A score of ‘3’ means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch’s ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch’s ESG Relevance Scores, visit https://www.fitchratings.com/topics/esg/products#esg-relevance-scores.

DATE OF RELEVANT COMMITTEE

18 June 2024

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

MACROECONOMIC ASSUMPTIONS AND SECTOR FORECASTS

Click here to access Fitch’s latest quarterly Global Corporates Macro and Sector Forecasts data file which aggregates key data points used in our credit analysis. Fitch’s macroeconomic forecasts, commodity price assumptions, default rate forecasts, sector key performance indicators and sector-level forecasts are among the data items included.

Additional information is available on www.fitchratings.com

Additional information is available on www.fitchratings.com

PARTICIPATION STATUS

The rated entity (and/or its agents) or, in the case of structured finance, one or more of the transaction parties participated in the rating process except that the following issuer(s), if any, did not participate in the rating process, or provide additional information, beyond the issuer’s available public disclosure.

APPLICABLE CRITERIA

- Corporates Recovery Ratings and Instrument Ratings Criteria (pub. 13 Oct 2023) (including rating assumption sensitivity)

- Corporate Rating Criteria (pub. 03 Nov 2023) (including rating assumption sensitivity)

- Sector Navigators – Addendum to the Corporate Rating Criteria (pub. 21 Jun 2024)

APPLICABLE MODELS

Numbers in parentheses accompanying applicable model(s) contain hyperlinks to criteria providing description of model(s).

- Corporate Monitoring & Forecasting Model (COMFORT Model), v8.1.0 (1)

ADDITIONAL DISCLOSURES

ENDORSEMENT STATUS

| Waste Pro USA, Inc. | EU Endorsed, UK Endorsed |

DISCLAIMER & DISCLOSURES

All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings. In addition, the following https://www.fitchratings.com/rating-definitions-document details Fitch’s rating definitions for each rating s

READ MORE

SOLICITATION STATUS

The ratings above were solicited and assigned or maintained by Fitch at the request of the rated entity/issuer or a related third party. Any exceptions follow below.

ENDORSEMENT POLICY

Fitch’s international credit ratings produced outside the EU or the UK, as the case may be, are endorsed for use by regulated entities within the EU or the UK, respectively, for regulatory purposes, pursuant to the terms of the EU CRA Regulation or the UK Credit Rating Agencies (Amendment etc.) (EU Exit) Regulations 2019, as the case may be. Fitch’s approach to endorsement in the EU and the UK can be found on Fitch’s Regulatory Affairs page on Fitch’s website. The endorsement status of international credit ratings is provided within the entity summary page for each rated entity and in the transaction detail pages for structured finance transactions on the Fitch website. These disclosures are updated on a daily basis.

Release information provided by Fitch Ratings: https://www.fitchratings.com/research/corporate-finance/fitch-assigns-waste-pro-first-time-b-idr-outlook-stable-15-07-2024